Cat C Market Consolidation: Where Will We Be in 2030?

Chatting to one of the independent single site machine operators in the UK market the other day, several things became apparent. The first thing is that this is not a sector of the industry that many would choose to enter any more.

With the majority of the retail contracts being held by a few players – who can supply their own machines – it is almost impossible for an independent operator or an independent AWP manufacturer to gain significant ground. “If a contract comes up, then how can a smaller operator compete and then go to buy machines from a manufacturer which is owned by a rival operator?” said the independent. Vertical integration – as it is termed – meaning the supply of machines directly from the manufacturer through to the operations is nothing new of course but there is no doubt the effects are being felt among the smaller players.

Should retailers do more?

Some believe the retailers should do more to protect the supply chain and ensure there is choice of machine in the market but the bottom line appears to be – well – the bottom line. “Operator performance doesn’t seem to matter as much as price, which is frustrating. Even if the price difference is marginal and even if we have proven ourselves to get better performance from the machines on site for our customers, increasingly it doesn’t seem to matter,” added my source.

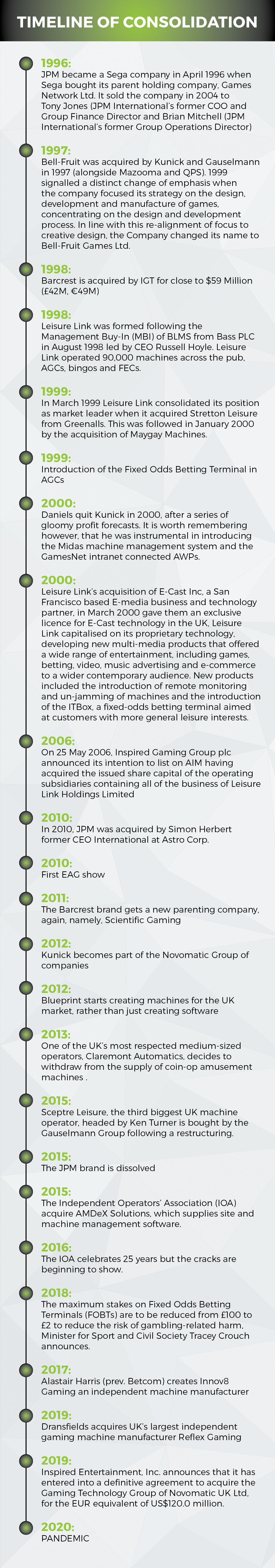

This got me thinking back to the chess game of acquisitions and counter acquisitions that has led us to this situation and which also resulted in the disappearance of many of the brands in British fruit machines that were household names two decades ago.

In the mid 1990s – Barcrest for example – was producing over 40,000 AWPs a year not just for the UK market but for export markets across the world. Brands such as Maygay, JPM and Bell-Fruit Machines (later to become Bell-Fruit Games) would vie for stand space at Earls Court for ATEI. A decade later and we see an unprecedented flurry of market activity – as internet connected machines and ultimately digital AWPs finally enter the largely analogue UK market and overseas investors see their chance to impose their successful market models.

Post-pandemic, machine revenue is good, according to Simon Barff at CLMS – even at pre-pandemic levels. But how much of this is due to the migration of FOBT players put off by the reduced stakes in LBOs? Pub numbers are reducing, putting extra pressure on the market.

The independent operators remaining in the UK marketplace are among the savviest in the sector. Many have younger generations taking the business forward and are diversifying into new areas of operation. Some big names are gone, such as Claremont and Trident – formerly SE Leisure (now in a new era as Fortuna) and the major players such as Dransfields, Keeday and SX are buying up smaller operations who no longer wish to compete.

It seems to me that there is a very delicate eco system in place in the UK single site operating sector right now. It would only take the disappearance of one or two more independents and the balance of purchasing power will surely shift away from the retailer for good

Where will we be in 2030?

12 July 2023

No comments have been posted yet.

Please sign in or join the network to post comments

Joyce's Column: August

I can hardly believe that we are virtually at the end of August already, this year has just flown by, the mornings are not as light and the nights...

Spotting the Signs: How CLMS Helps Combat Machine Fraud

Fraud in gaming machines is a persistent threat - one that costs operators and the wider industry not only financially, but reputationally too. While...

“Save Our Seaside” – Why Smart Investment is Key to Keeping Arcades Alive

The latest polling released by Bacta last week sends a powerful message: the British public doesn’t just like amusement arcades – they see them...