Driving Performance: How CLMS Gets Under the Bonnet of AWP Data - by Simon Barff

As operators seek to navigate an increasingly competitive post-pandemic market, the question of where and how to invest in new Category C (AWP) machines is more crucial than ever. But it’s not as simple as choosing the machine with the highest weekly net balance. According to CLMS, the UK’s most established machine data audit and performance benchmarking firm, operators who want to maximise their returns need to take a far more nuanced, data-driven approach.

Just as you wouldn’t buy a car based solely on horsepower, selecting the right AWP for your estate requires considering a range of factors. Would you drive a car without checking its miles per gallon, maintenance history, or comfort levels? Probably not, and the same logic applies to gaming equipment.

Data-Driven Insights That Matter

Over more than 30 years, CLMS has developed and refined a robust set of metrics that provide an industry-standard evaluation for pub sector machines. These measures, updated to reflect the digital evolution of the sector, are now available to operators and suppliers alike through the CLMS Dashboard - providing real-time, comparable, and strategic performance insights.

At the heart of this approach is a suite of tools that go beyond surface-level figures:

• Indexing (%): This is the backbone of machine comparison, showing how a new machine performs in relation to the one it replaced. It’s a true benchmark of uplift; comparable to checking how a new car performs against your old reliable model on real-world fuel efficiency.

• Success Rate (%): This reflects how many machines in a given batch outperform their predecessors. A high percentage indicates consistency and broad appeal; like a car with a reputation for reliability across drivers.

• Average Net Balance (ANB): The weekly average earnings of a machine, which can be skewed if machines are only trialled in high-value positions. Think of it like car performance measured only on a downhill stretch: it tells a story, but not the whole one.

These figures matter because investing in gaming equipment is increasingly high-stakes. Machines are staying on site longer, digital content cycles are more rapid, and the sheer variety of cabinets, game packs and payment peripherals means it’s all too easy to make the wrong call.

It’s Not Just What You Buy, It’s Where You Place It

CLMS stresses that interpreting data in context is key. A good ANB isn’t always a sign of success; if the machine replaced a well-performing unit, the uplift might be negligible. Conversely, a modest ANB on paper might represent a huge jump over a poorly performing predecessor. Indexing corrects for this by showing percentage improvement over the last known trading performance.

Then there’s longevity. Digital machines often show early volatility - peaking or dipping in the first few weeks. The CLMS methodology incorporates “time on site” to ensure that success isn’t judged prematurely or based on short-term anomalies. Like breaking in a new car engine, sometimes machines need time to reach optimal performance.

The Competitive Landscape is Shifting

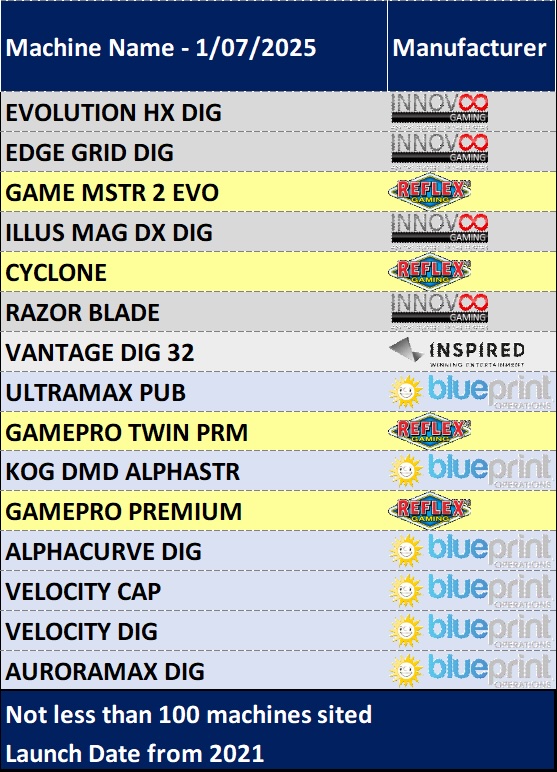

Using data from machines launched since 2021, CLMS has identified an intriguing trend: the early dominance of manufacturers like Blueprint and Inspired is being steadily challenged by newer models from Innov8 and Reflex. While all four major manufacturers remain highly competitive, the variance in performance across different estates, regions and game mixes underscores the need for detailed evaluation.

No single manufacturer has the magic formula, because there isn’t one. Performance is influenced by cabinet design, content mix, screen format, volatility settings, placement, and customer demographic. In this respect, a machine isn’t just a product, increasingly, it’s part of an ecosystem.

Empowering Smarter Decisions

For operators, the CLMS Dashboard now offers instant access to unbiased performance data gathered across hundreds of sites and thousands of machines. It’s the equivalent of having a test drive, review ratings, and fuel economy stats for every model; helping them place smarter bets on what will work in their unique venues.

In an industry where margins are tight and expectations are high, this level of insight is no longer a nice-to-have, quite frankly, it’s essential.

If your investment strategy is still based on anecdotal evidence, sales rep persuasion, or one-size-fits-all thinking, it might be time to hit the brakes. Today’s most successful operators are those who treat machine investment as seriously as any other business asset, by balancing performance, risk, and return using solid, strategic data.

If you would like to see the figures behind the graphic - contact Simon Barff for more details

3 July 2025

No comments have been posted yet.

Please sign in or join the network to post comments

Colin Mallery Has Died

It is with great sadness that we report the passing of one of the industry’s great characters – Colin Mallery died on Saturday.

Let’s Talk Contactless: Clacton Pavilion Makes Further E-Service Investment

If there’s one shift the industry can’t ignore, it’s the rise of contactless. Pool tables, amusement machines, redemption equipment and change...

Message from Joseph Cullis Regarding Next Week’s Budget

With the Autumn Budget only a week away, I wanted to provide a short update on where we feel things stand and the work that Bacta has been doing on...