How AWP Performance Can Differ Due to Region

by Simon Barff of CLMS

Following on from our recent article on how data can support crucial purchasing decisions, we’ve had a surge of enquiries from machine suppliers keen to understand what’s really working in their specific operating territories.

Using performance data from over 35,000 connected machines, CLMS has been able to support suppliers across Scotland, the North West, East of England, Central London, and the South Coast – offering regional insights that go far beyond anecdotal evidence.

With new machines now costing many thousands of pounds and content agreements often tying operators in for five years or more; selecting the right equipment isn’t just a commercial decision; it’s a strategic one. And for independent and SME suppliers who don’t have the backing of international investors, it’s a decision that can define long-term profitability.

These choices need to be supported by solid, data-led intelligence, not just a slick sales pitch. That’s where CLMS comes in.

Real-World Impact

Our recent work with operators has not only validated upcoming investment plans but in several cases, has helped businesses avoid costly purchasing errors. By drilling down into the performance of machines via our OLGA Online reporting platform, we can clearly see that machine success is heavily influenced by local player preferences – and those preferences can vary significantly by region.

Take London as a prime example. While the top five or six games on each cabinet tend to be consistent, in the Greater London area we see a much higher percentage of revenue generated by high-volatility games. This trend is particularly pronounced in AGC venues, where European-style Novomatic and Amatic titles consistently top the charts.

This kind of insight is crucial when evaluating which machines – and content types – will perform best in a specific region.

Cultural Nuances in Scotland

Further north, in certain regions of Scotland, we’ve observed unique behavioural patterns that may surprise suppliers unfamiliar with the territory. For example, there’s a notable avoidance of green- or blue-themed games within particular player sets.

The reason? As many Scottish operators will tell you: “The Protestants don’t like green, and the Catholics don’t like anything blue.” It might sound surprising, but these local sensitivities are well known in the trade – and they matter.

In fact, we believe this was one of the reasons why digital products took longer to gain traction in Scotland. A game like Luck of the Irish, for example, struggled in certain areas simply because half the local population wouldn’t play it.

It’s even reached the point where experienced Scottish operators can tell you which pubs have which denomination, and they stock machines accordingly.

Informed Choices Start with Data

In short, machine performance is local and understanding your local market has never been more critical. Whether you’re weighing up a new cabinet or assessing the long-term value of a content deal, the right data can save you from costly mistakes and maximise your returns.

If you’re interested in learning more about machine performance in your specific operating region, or would like help comparing supplier options, please don’t hesitate to get in touch.

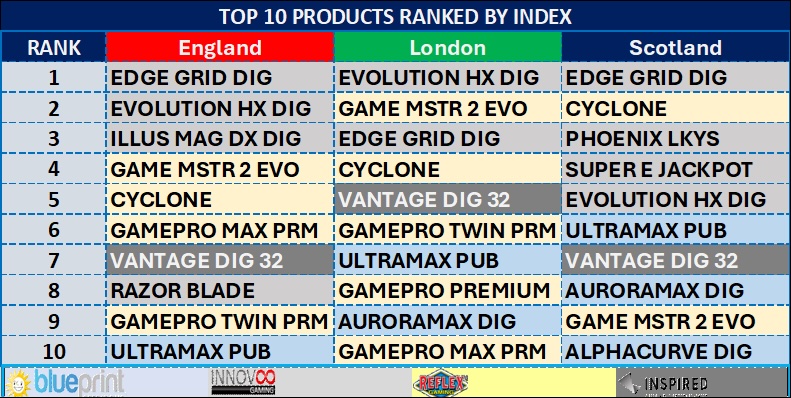

Below is a sample of the variances between game performance across specific areas of the UK. The depth of our coverage, number of machines covered and intelligence reporting tools allows us a unique insight into the performance of products across all regions of the united kingdom.

24 July 2025

No comments have been posted yet.

Please sign in or join the network to post comments

E-Service Announced as Exclusive Dyna|spheres® UK Distributor

Pool season is officially underway and E-Service is ready to deliver. Our latest container arrived on Friday, and with pre-orders already allocated...

Merkur’s Northern Ireland Move: Oasis Retail Services Acquisition Signals Sector Consolidation

Gaming group Merkur Casino UK has completed the acquisition of Northern Ireland’s leading amusement-machine operator, Oasis Retail Services —...

SEGA Amusements International Brings Hasbro’s Iconic SIMON Game to Arcades for the First Time!

SEGA Amusements International has revealed its latest skill-based redemption title, SIMON Arcade, bringing Hasbro’s iconic memory game to arcades...